The time is ripe for homebuyers in Chicago, with affordability up from last year and new programs to boost housing supply going into summer of 2024. Buying your first property isn’t cheap, however, with closing costs and cost of living making it hard to budget for your Chicago dream home.

Whether it’s better interest rates, tax deductions, or city-wide grants, these six Chicago programs can save you thousands when buying your first home.

Looking to buy a long-term home in Chicago?

IHDAccess Forgivable is a must-have for first-time Chicago homebuyers on a budget.

#1 – IHDAccess Forgivable

IHDAccess is a special program offered by the Illinois Housing Department Authority, which grants you up to $6,000 in financial assistance to cover any unexpected fees or closing costs when buying a Chicago property.

Although directed to first-time homebuyers, this program is available to anyone who meets the qualifications–whether it’s their first home or their tenth!

Here’s what you need to qualify:

- Meet the Illinois household income and purchase price limits

- Minimum 640 credit score

- Live in the home as a primary residence for 10 years

- Complete an eight-hour homeownership education course before sale

Contributions from IHDAccess vary from the minimum $1,000 or 1% of property value to the maximum $6,000 or 4% of property value and are given in the form of a 10-year loan with zero interest forgiven monthly.

#2 CHA Purchase Assistance

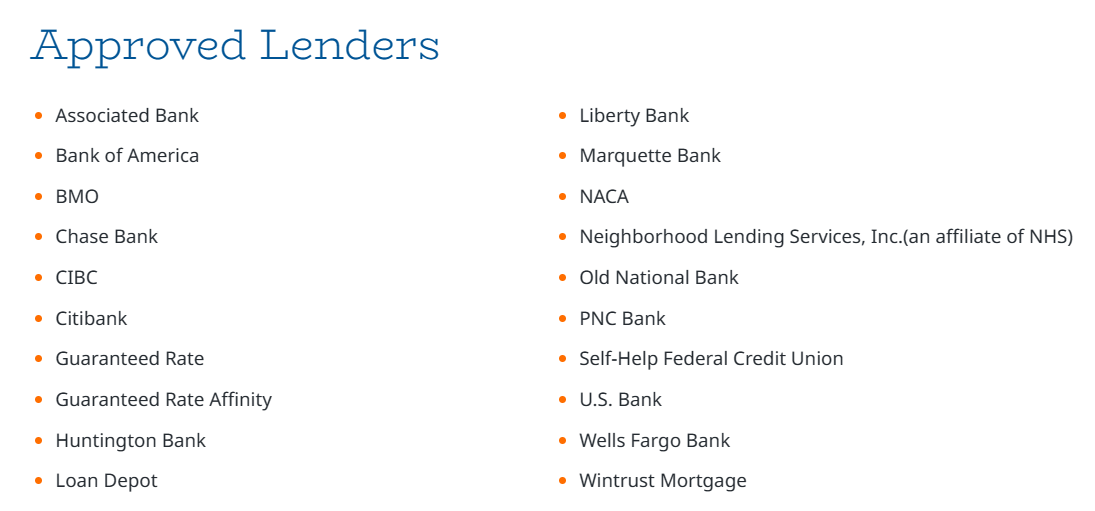

CHA applicants must be pre-approved by one of the approved vendors on this list.

This can be used to cover as much as 20% of your down payment, and for CHA residents there isn’t a maximum percentage for coverage at all!

Here’s what you need to qualify:

- Be a U.S. citizen

- Have valid pre-approval from a CHA-approved vendor (see image)

- Debt-to-income of 45% or less

- Must contribute at least $3,000 to purchase of the property

- Must be a 1-4 unit residential or condominium that will be your primary residence

- Must complete an eight-hour homeownership education course before sale

- Applicant must be a first-time homebuyer

- Must remain owner-occupant of the purchased property for at least 10 years

Income eligibility for CHA purchase assistance ranges from anywhere under 80% of the area median income (AMI) for regular Chicago homebuyers, to anywhere under 120% AMI for CHA residents.

#3 TIF Purchase Rehab

The Tax Increment Finance Purchase Rehab program, also known as TIF Rehab, provides Chicago homebuyers with assistance ranging from 30-50% of renovation costs when buying fixer-upper homes in specific districts inside the city limits.

Make sure your property falls inside a TIF district before applying for purchase rehab.

Here’s what you need to qualify:

- Can obtain a mortgage from a pre-approved lender (NLS or US Bank)

- Must not owe money to the City of Chicago, or be an employee of the city

- Renovations/restorations must be completed 180 days after close

- Property must be located in a participating TIF district (see image), vacant for at least 1 month, and with estimated renovation costs of at least $10,000 per unit

- Must attend an eight-hour homebuyer education course

Buyers must have a household income of less than 150% of the area median income (AMI), as well as intend on living in the purchased property for at least 5 years. Unlike most programs mentioned here, TIF funding comes in the form of a tax subsidy instead of down payment assistance.

Applying for TIF also means looking into fixer-upper properties, which may or may not suit your needs depending on a few key criteria. See our video on the fixer-upper real estate market to find out if these property types work best for you.

“If you’re Sally and Steve home buyer you may want to skip out on this…”

— Ben Lalez

#4 Illinois HRAP

The Home Repair and Accessibility Program offers 3-5 year forgivable loans of up to $45,000 for Chicago homebuyers who are buying fixer-uppers or current residents looking to renovate their home.

Here’s what you need to qualify:

- Approved by a vendor on the list of HRAP Grantees

- Total household income under 80% AMI

- Resident must live in, or intend to live, in the property as a primary residence

- The property must have a documented need for health, safety, or accessibility repairs

A $21,500 loan is also available for those looking to renovate just the roof of their property, with similar eligibility requirements as above.

Although previously only available in five localities, as of May 2024 BNAH is available for anyone buying a home in the city of Chicago.

#5 BNAH

The Building Neighborhoods and Affordable Homes Program offers up to $100,000 in financial assistance for Chicago homebuyers looking to purchase a newly constructed single-family home.

Here’s what you need to qualify:

- Property must be a new construction located in the Chicago area

- Household income must not exceed 140% AMI

- Buyers must occupy the property as their primary residence for at least 10 years

- Must be a single-family property (1-4 units)

#6 NACA

The Neighborhood Assistance Corporation of America is one of the best options for Chicago homebuyers on a budget, with below-average mortgage interest rates and no additional fees, costs, or down payments required.

Here’s what you need to qualify:

- Must be a NACA member ($25/year dues, plus volunteer work)

- No ownership interest in other properties at time of closing

- Must live in the home as a primary residence for the duration of the NACA mortgage

- Must have a consistent on-time payment history over the last 12 months

- Must not exceed the maximum purchase price in the property’s area

- Must be employed with at least 12 months of work history, or self-employed with verifiable business income

- Must have debt-to-income of less than 40%

NACA does not have a credit score requirement, unlike most other lenders, using payment history as a measure instead. Although getting approved can take months or years of paperwork and preparation, NACA mortgages remain one of the best ways to finance your first home in Chicago while saving thousands of dollars for years to come.

Ready for Your First Chicago Home?

Buying your first Chicago home should be easy, and with these six programs you can take some of the hassle out of home-buying. Ready to get a head start on the May home-buying season?

Talk to a real estate expert and make your homeownership dreams a reality today!

Sources

Illinois First-Time Home Buyer Programs in 2024 | LendingTree

Illinois First-Time Home Buyer | Programs & Grants (themortgagereports.com)

Program Income Limits | IHDAmortgage.org

NHS Chicago | Empowerment Through Homeownership

CHA Purchase Assistance Program | NHS Chicago

Illinois starts offering grants for home improvement for low-income residents | WCIA.com

CHA Purchase Assistance Program | NHS Chicago

TIF Purchase Rehab | NHS Chicago

Education on Housing Options | NHS Chicago

City of Chicago :: Area Median Income (AMI) Chart

DOH’s Building Neighborhoods and Affordable Homes Program Expands City-Wide

IHDA – Home Repair & Accessibility Program (HRAP) – Illinois Institute for Rural Affairs