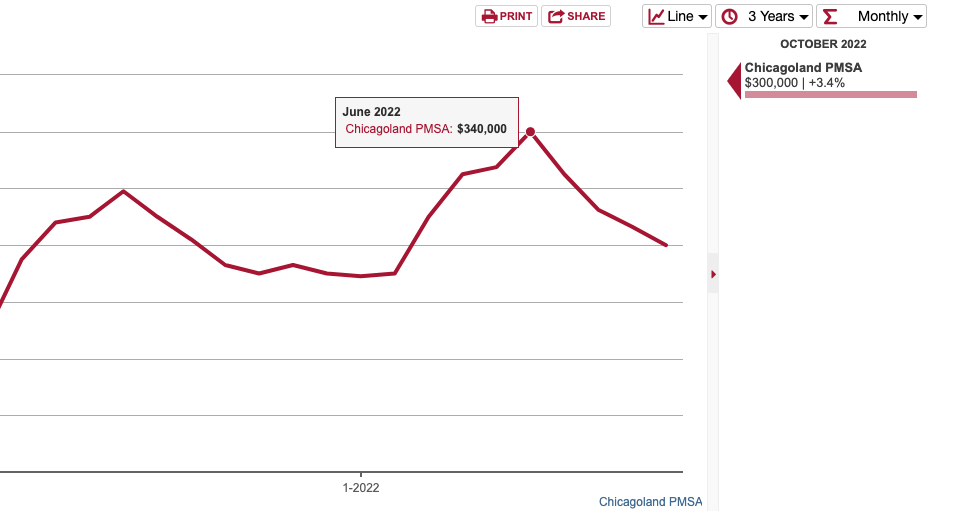

As interest rates continue to increase, housing demand in Chicago has plummeted. Closed sales have decreased by 33% since the June peak, but why does that ultimately matter? Well…Prices are finally going down.

Home prices in the Chicagoland area dropped by 13% in October compared to June. That’s partly due to seasonality. Housing prices always peak in June and decline towards the winter in Chicago. But this year, that curve is steeper (nuances, I know).

So you’re asking yourself: should I lock my mortgage rate today?

While your purchasing power is not quite as high as the times of outrageously low sub 3% interest rates, here are a few benefits of locking down an attractively priced home even at current rate levels:

- Mortgage rates are unlikely to stay this high, and before long, you’ll have the chance to refinance into a lower monthly payment.

- Home appreciation is a reliable cushion against inflation.

- Even if I’m wrong (I’m not) and higher mortgage rates become the new normal, as long as you’ve locked in a monthly payment within your means, you’ve gotten a head start in building your home equity, and you’ll be happy you took action sooner than later.

In short, buy with a 5-year outlook and lock in a monthly payment within your means, and you won’t regret it.

Real Estate: Preparing for Spring Market in Chicago

Date the Rate, Marry the Home (eww).

If you’ve been paying attention to real estate news, you might have heard the saying, “date the rate, marry the house.” It’s cringe but true.

It means that you should focus on buying a home that suits you regardless of the mortgage rate since you can always refinance when the interest rate goes down.

This is good and bad advice. Let me explain.

The Good

All the fluctuation in the market is making buyers hesitate even when they’re in a position to get a good deal. So it’s good to reframe the purchasing decision in a way that brings it down to the basics.

Forget mortgage rates for a second and concentrate on this:

- Will this home suit your lifestyle for at least five years?

- Is the monthly payment within a comfortable range for you?

If you answered yes to those questions, you could pull the trigger knowing that you will likely receive a significant discount on your downpayment when interest rates go down.

The Bad

“Date the rate, marry the home” can be interpreted as an encouragement to suffer through overly high mortgage payments in the short term while banking on a discount through refinancing later on.

While it’s very likely rates will go down, we honestly don’t know that for sure. And most importantly, we don’t know how much they would go down if they did. So I would advise buyers against making this type of gamble.

Want to learn more about mortgages? Click below to watch our video on the basics!