In my business, everyone always expects property values to go up indefinitely. And unfortunately, that isn’t always the case.

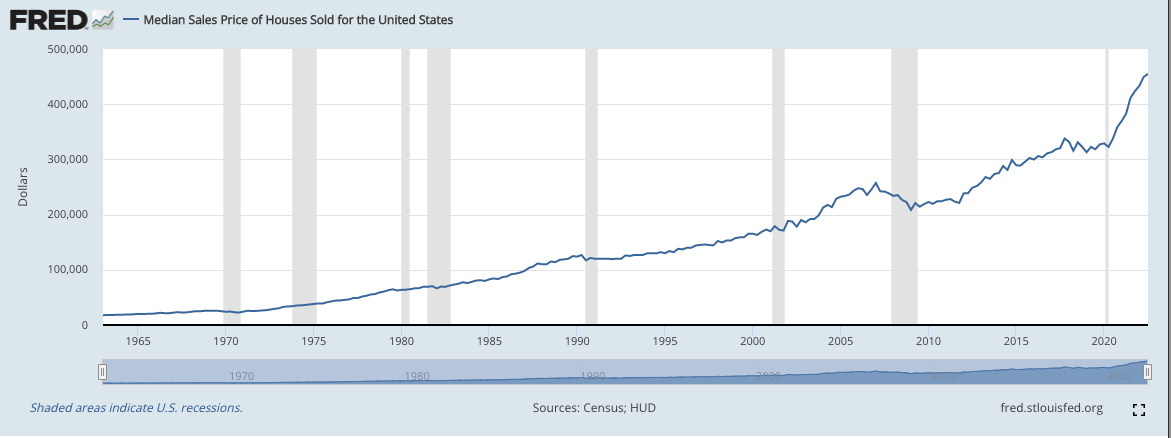

A decrease in property value doesn’t mean declining market prices. In fact, the real estate market has shown consistent growth throughout history, even accounting for significant dips like in 2008.

Maybe you bought a little too high, or maybe the neighborhood didn’t appreciate as you expected, and now you have to sell below your purchase price.

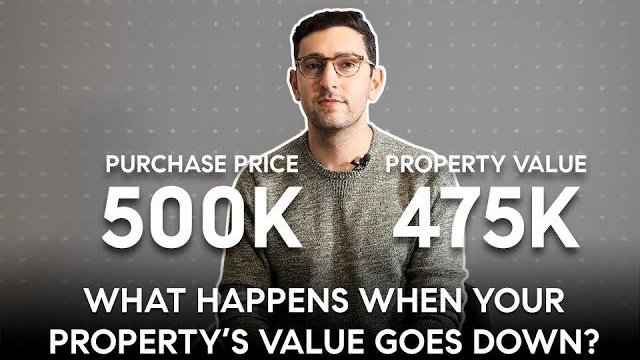

So what do you do when the property values go down? Let’s use numbers in this scenario.

Let’s say you bought your home at $500,000, and the market tells you you can only get $475,000.

Yes, your property value did go down, but there are other things people often neglect.

-

There’s a good chance your mortgage payment is lower than the cost of renting that same property. So you had a higher quality of life for however long you were there.

- If you’ve been living in this home and paying a mortgage for a fair amount of time, then you’ve been building equity by paying your principal monthly. That’s why we recommend buyers plan to live in their homes for at least three years, ideally longer. So, if you play your cards right, you can often break even and walk out, recouping your down payment even if the value of your home is significantly lower.

- People often need to remember to account for the interest expense deduction on their property. So they’ve been saving on their taxes year over year.

It’s not always as simple as, “alright, I bought for $500,000, it went down to $475,000, so I lost $25,000” It’s a much more complex thing.

If you’ve done your due diligence before buying, it’s extremely rare to be in a position where you have to sell your home at a loss. But even if you sell at a loss, the cost-benefit analysis often favors buying over renting. If you are considering a refinance or a home equity line of credit, you can also check out our guide on how to find a mortgage lender.