If you’re asking yourself, “am I ready to buy a house,” look no further.

Are you on the fence about finally buying a house? The decision is a huge one, especially with so many factors to consider. But don’t worry — we’re here to help you figure out if it’s the right time for you to become a homeowner. Ask yourself these six essential questions before taking the plunge to ensure you’re as prepared as possible!

1. Do I have a steady income to cover a mortgage payment?

This might come as a shock (disclaimer: sarcasm), but If you’re not making money, you won’t be able to pay your mortgage. The bank is almost purely interested in whether or not you have a good credit history, meaning they expect you to make your monthly mortgage payment on time, and the consequences if you don’t, aren’t light.

You need to make sure your income is enough to cover your desired mortgage payments in the long term, as well as all of your other expenses, such as taxes, homeowners insurance, utilities, etc.

You will also want to ensure your income source doesn’t change dramatically during the buying process. Any major changes to your financial status during the transaction will likely derail the whole process, including making large purchases like buying a car.

If you feel ready to buy but want an expert to help guide you, start by getting a pre-approval from your local mortgage lender. This is an excellent way (and the most accurate) to ensure that you’re in the right financial position before moving forward — no guesswork is required.

2. Am I renting and getting very little in return?

If you live in Chicago, rents have been steadily increasing for as long as we can remember. We have clients spending close to $5,000 a month and not getting anything in return for that.

Renting has its own reward, including greater flexibility and less responsibility, yet it won’t build equity or tax benefits like owning does.

Equity is the difference between what a homeowner owes on their mortgage and the actual value of their home. In a way, it’s like paying yourself every month because every mortgage payment you make increases the potential cash return from selling your house.

You will also build equity from the appreciation of your home. According to NeighborhoodScout.com, Chicago’s housing appreciation rate has averaged 5.37% per year over the past ten years. That’s often higher than inflation! But even in years like 2022, your home appreciation will offer a welcome cushion against high inflation. Not to mention it’s almost impossible to find a savings account that yields a 5% return on your money.

But wait, there’s more! As a homeowner, you can deduct up to $10,000 in interest payments from your taxes yearly.

If you are a renter and you love being able to move from location to location, or maybe you love having your landlord come in and fix the toilet, the sink, or some holes in your drywall, then maybe renting is for you. But if you’re spending that kind of money, you really should be getting a ton in return and building your financial future.

3. Do I have enough money saved for my down payment?

You’ll have to put some money down in most transactions — but how much is enough? There really is no single correct answer to this question — your total down payment will depend on you and your financial situation. Many people have heard of a 20% down payment as a golden rule, but that’s not a one-size-fits-all tactic. In fact, the average down payment for first-time home buyers in the US is 7%, and some loan products will allow you to put down as little as 3.5%. There may be some options for zero down payment, or down payment assistance as well.

Most people think of 20% as the right amount for a down payment because of private mortgage insurance. Private mortgage insurance (PMI) is an insurance policy borrowers must pay for when taking out a mortgage loan with a down payment under 20%. This type of insurance protects the lender in the event of default by the borrower and covers the majority of any losses on the loan. PMI will usually add between $50-$200 to your monthly payment, and buyers can waive the PMI fee once they’ve reached 20% equity in their home.

Make sure you spend some time doing the math to see what kind of down payment you can afford and how that down payment will affect your mortgage interest rate. And don’t forget to factor in closing costs, another lump sum you’ll have to pay before you can get the keys to your new abode. In most instances, closing costs will total an additional 2-3% which you’ll have to bring to the closing table. You can learn more about closing costs here.

4. Am I ready to take on more responsibility?

It’s a surprise to absolutely no one that purchasing a home is a huge decision — and with big decisions come big responsibilities. Before you start the process of buying a house, understand that owning comes with more chores than being a tenant. From yard work to maintenance bills, to having responsibility for any damages to the home, there’s plenty of not-so-fun work that comes along with homeownership.

We try to explain to our clients that buying a home is like entering into a new hobby: if you’re not ready to roll up your sleeves on a Saturday afternoon, fire up some YouTube and figure out how to change the furnace filter (which is surprisingly pretty easy), homeownership may not be for you just yet.

5. Am I committed to living in the same place for at least three years?

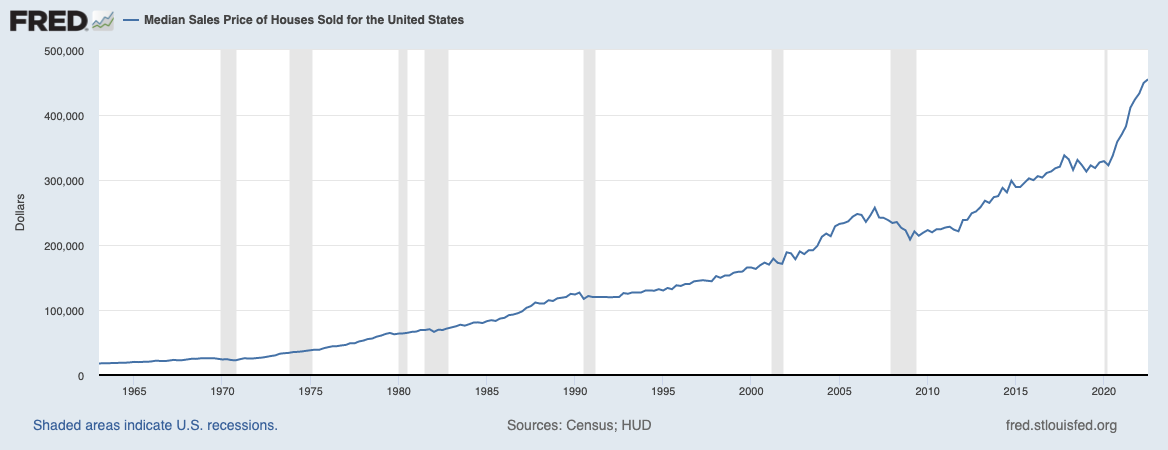

In the long run, there’s no doubt that your home’s value will appreciate (just look at a 20-year graph of housing appreciation in the US, and you’ll see a steady upward trajectory in the housing market). But anything can happen in a year, and although rare, there’s a chance your home value will go down in that short of a timeframe. The likelihood of depreciation will be much lower the longer you stay in the home.

Remember that even if your home value decreases in the short term, you will be able to ride it out as long as you’re able to make your monthly payments. And even in the unlikely case you have to sell your home for less than you bought it, you can avoid losing money by preparing accordingly. Learn more about what happens if your property value goes down here.

You also have to consider that selling your home comes with certain costs. You will have to pay a real estate agent, a lawyer, taxes, and city fees, to name a few. That’s why we tell our clients that they should only buy a home if they plan to set roots for the long run. At the very least, you should plan to stay there for 3 years to make sure you recoup your selling costs.

6. Do I know a good real estate agent?

Having a good real estate agent will make or break your home buying journey. They’re like having a GPS — they’ll get you to your destination quicker and with fewer bumps in the road. Not all real estate agents are created equal, though, so if you’re looking to buy a house, it pays to do a bit of research first.

Talk with friends and colleagues. Look up reviews online. Find out who is experienced and knowledgeable about the current market trends. Making sure you enlist an expert before taking the plunge on buying a home could save you time, money, and headaches in the long run! And if you’ve found your way to our website, we know a few good real estate agents — just saying.

To conclude, let’s review your responses. If the answer was yes to all six questions, congratulations! You’re ready to buy a home.

Want to dive into the details of the home buying process? Click below to download our comprehensive homebuyers guide so you can confidently start house shopping.