In this blog post, we will delve into the current state of national real estate trends, exploring key factors such as median home sales prices, inventory fluctuations, and the potential impact of interest rates on supply and demand. By analyzing the data and observing emerging patterns, we can better understand the market dynamics and make informed predictions about its future trajectory.

The national real estate market continued its recovery in the first half of 2023, rebounding dramatically from the slowdown in activity and price decline, which hit bottom in late 2022. On the macroeconomic front, despite intermittent financial crises, indicators have generally turned distinctly positive: Substantial recoveries in stock markets, a major decline in inflation, strong employment reports, and consumer confidence hitting its best reading since September 2021. Interest rates remain relatively high, commonly ranging between 6% and 7% this year, but to a large degree, it appears buyers have accepted these rates as the new normal – and a larger proportion of buyers have been paying all-cash.

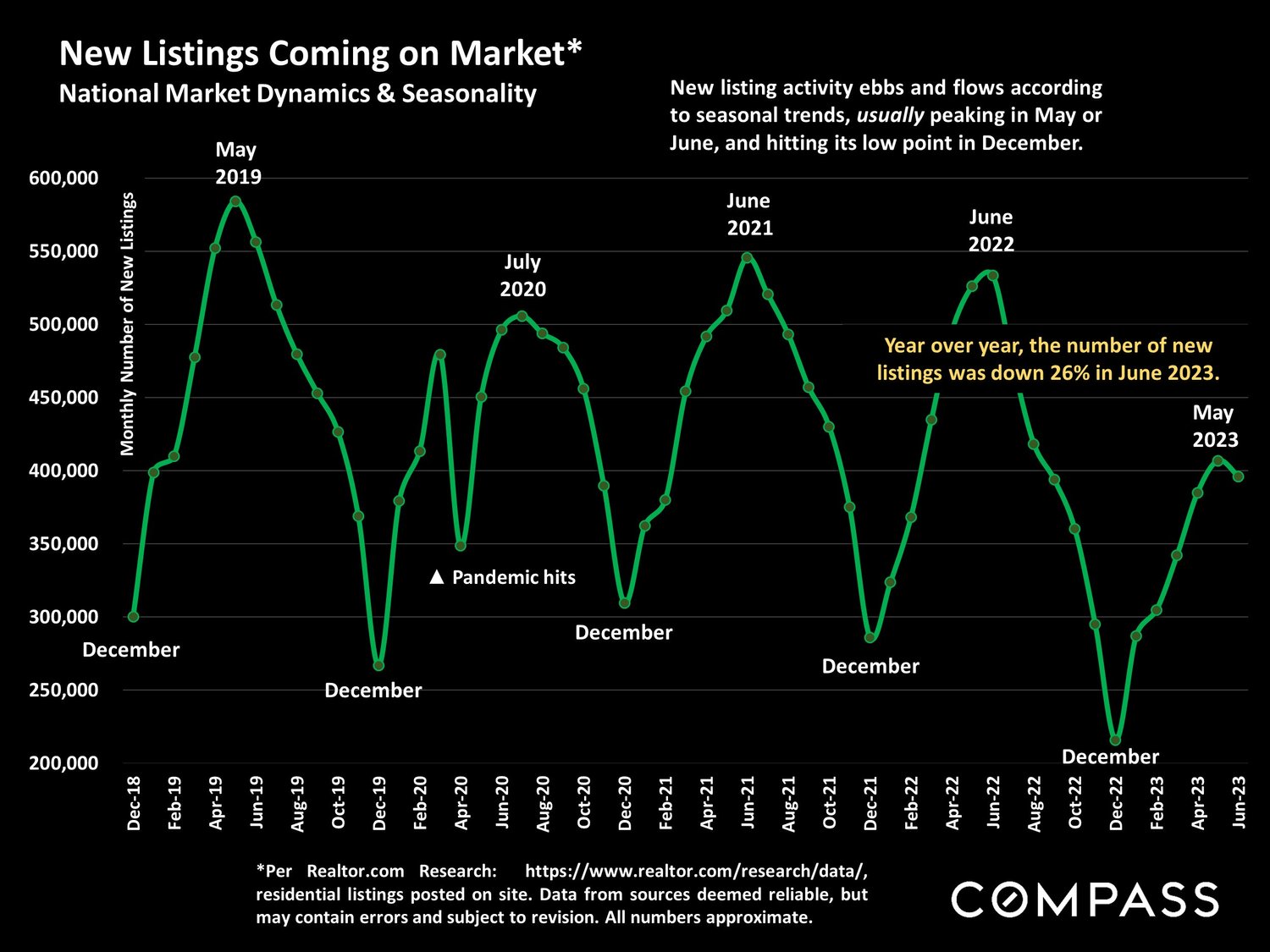

Buyer demand continued to climb through spring, but sales have been constrained by the steep decline in new listings coming on the market over the past 12 months, a decline generally ascribed to the “mortgage lock-in effect,” i.e., a reluctance of homeowners with low interest rate mortgages to sell and move. This has put upward pressure on home prices and accelerated newhome construction as developers seek to take advantage of low-inventory conditions.

Ultimately, the market is defined by the balance between demand and supply, and in 2023, it has tilted increasingly to sellers’ advantage, with homes selling faster, with more offers, for higher prices. Part of this is due to seasonal dynamics – spring is commonly the most active selling season of the year – but the change also reflects a rebound in psychology, with many buyers clearly deciding to move forward with their life plans.

A national report is necessarily a huge generalization of broad trends across an enormous range of regional submarkets whose values and market dynamics vary. How the data illustrated here applies to a particular home is unknown without a specific comparative market analysis. But let’s delve deeper into some important national real estate trends signals.

1. Median Home Prices:

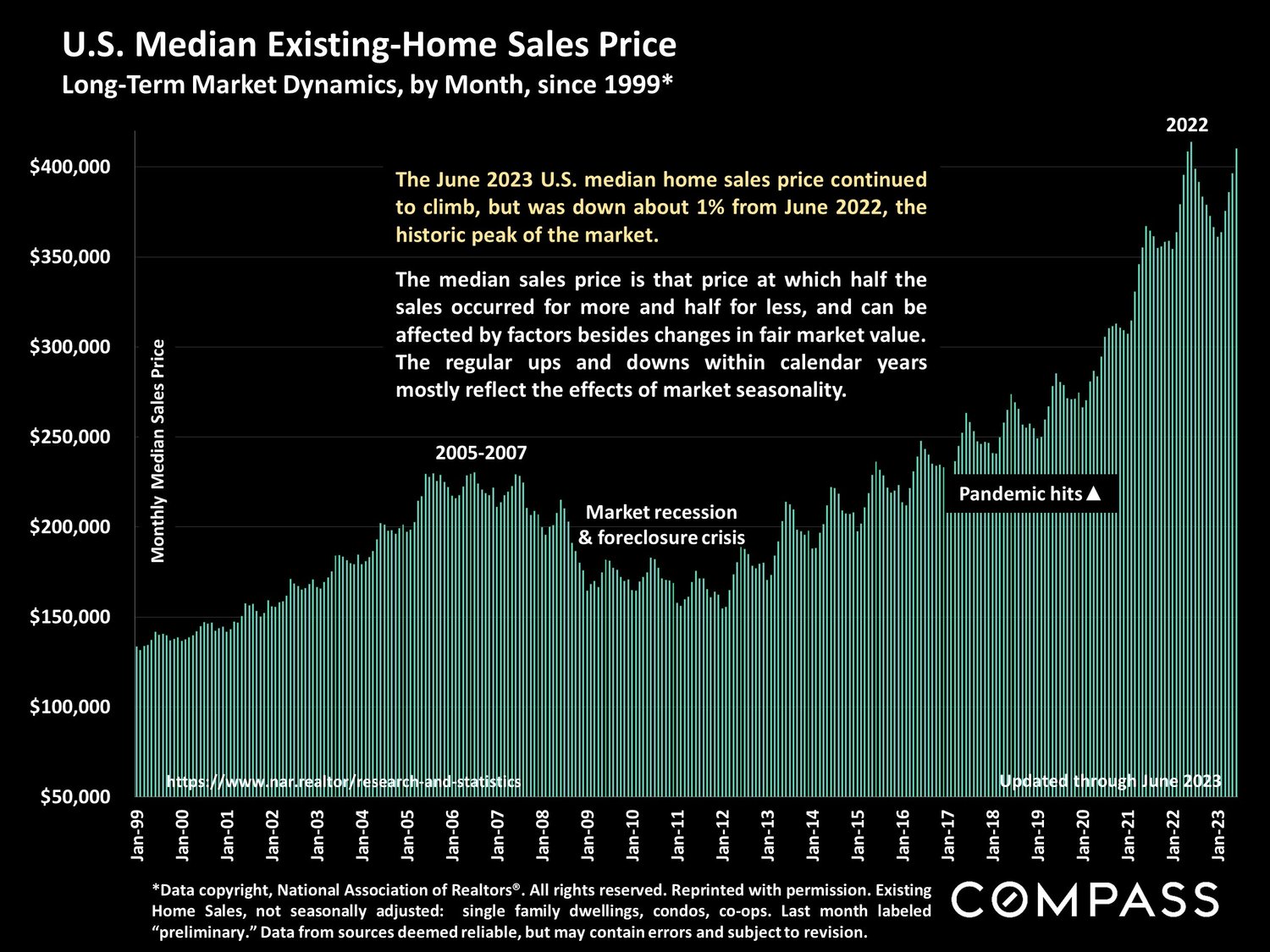

Since the start of the year, there has been a notable 1% increase in median home sales prices across the nation. To put this into perspective, let’s consider January 2006, when the median home sales price stood at $225,000. Today, that figure is approaching $400,000, showcasing a significant appreciation in real estate values.

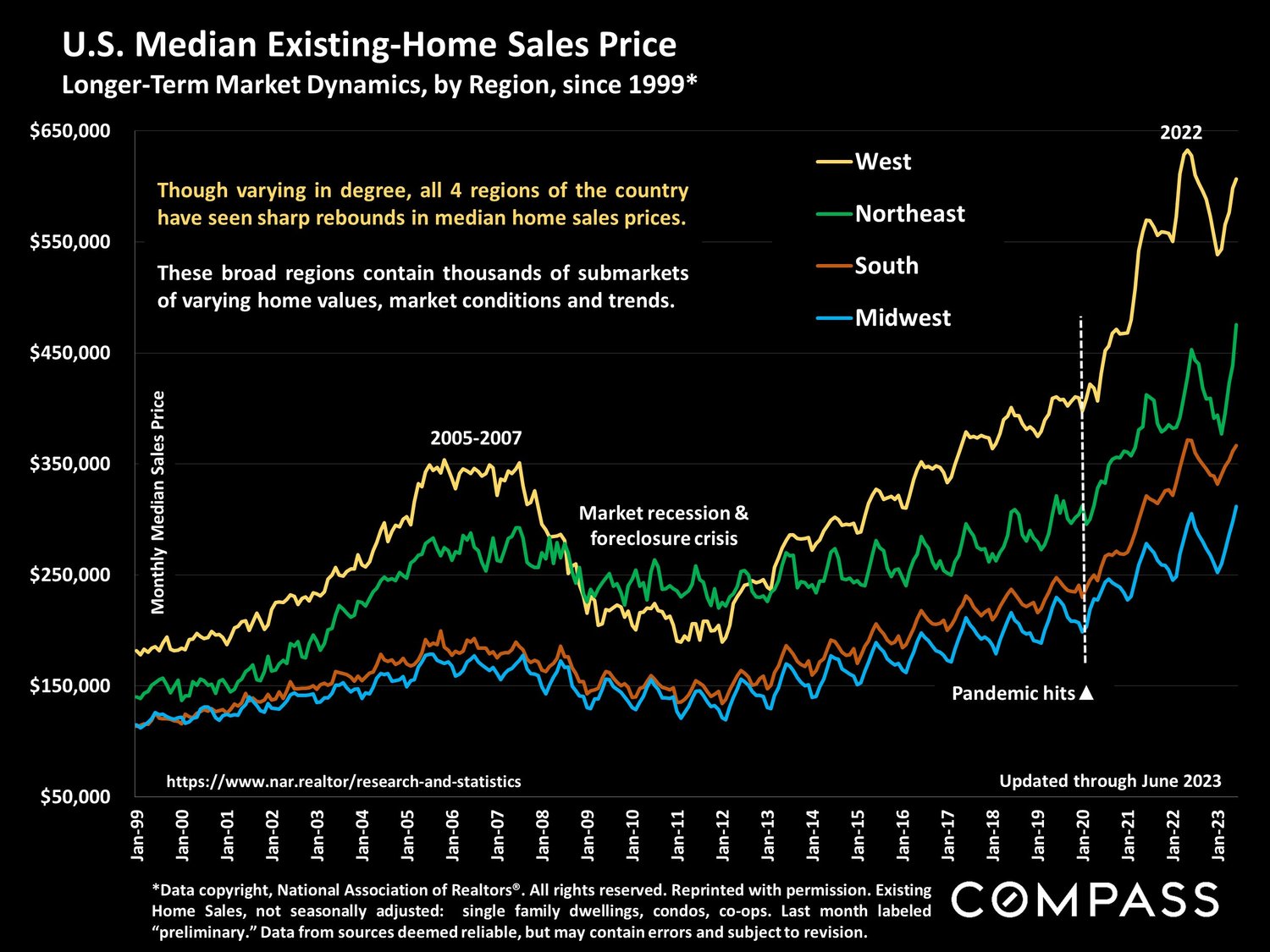

As illustrated above, the median home prices in June 2023 are just 1% below the June 2022 median sales price, the historic peak of the market. This data signals a strong buyer demand, despite the low supply and volatile mortgage ratesRegional home-price trends generally run roughly parallel over the longer-term, though varying in degree of change within periods due to local conditions.

2. New Listings and Inventory:

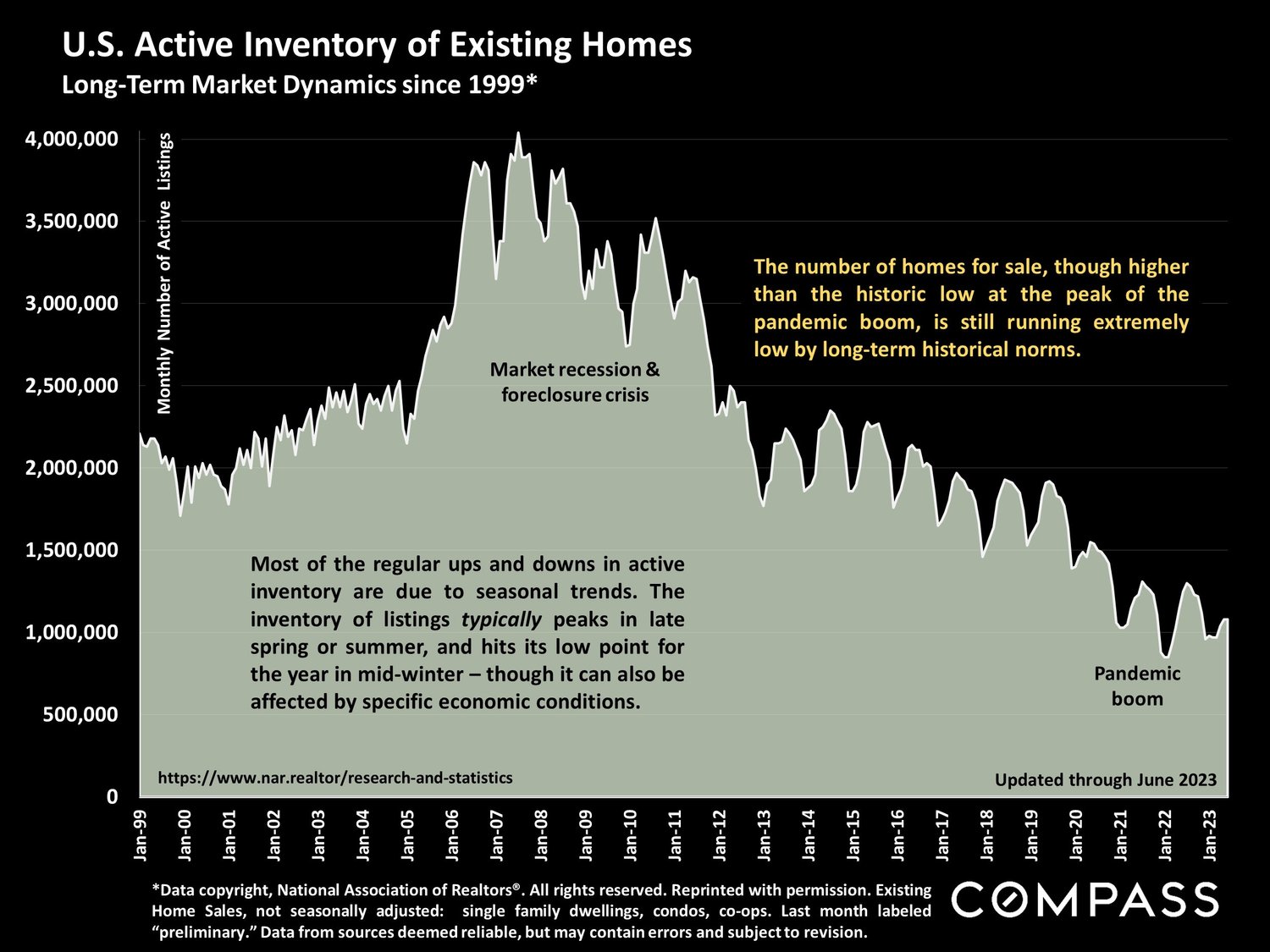

Similar to Chicago, the national real estate market is witnessing an influx of new listings. However, it is important to note that these new listings are not reaching the heights seen in a typical year like 2019. In fact, the inventory of existing homes has been steadily declining since 2013, with an accelerated drop in recent years, surpassing the rates of 2017, 2018, and 2019.

Over the past year, the severe, cumulative decline in the number of new listings has had major ramifications for market dynamics, and, in 2023, contributed to upward pressure on home prices.

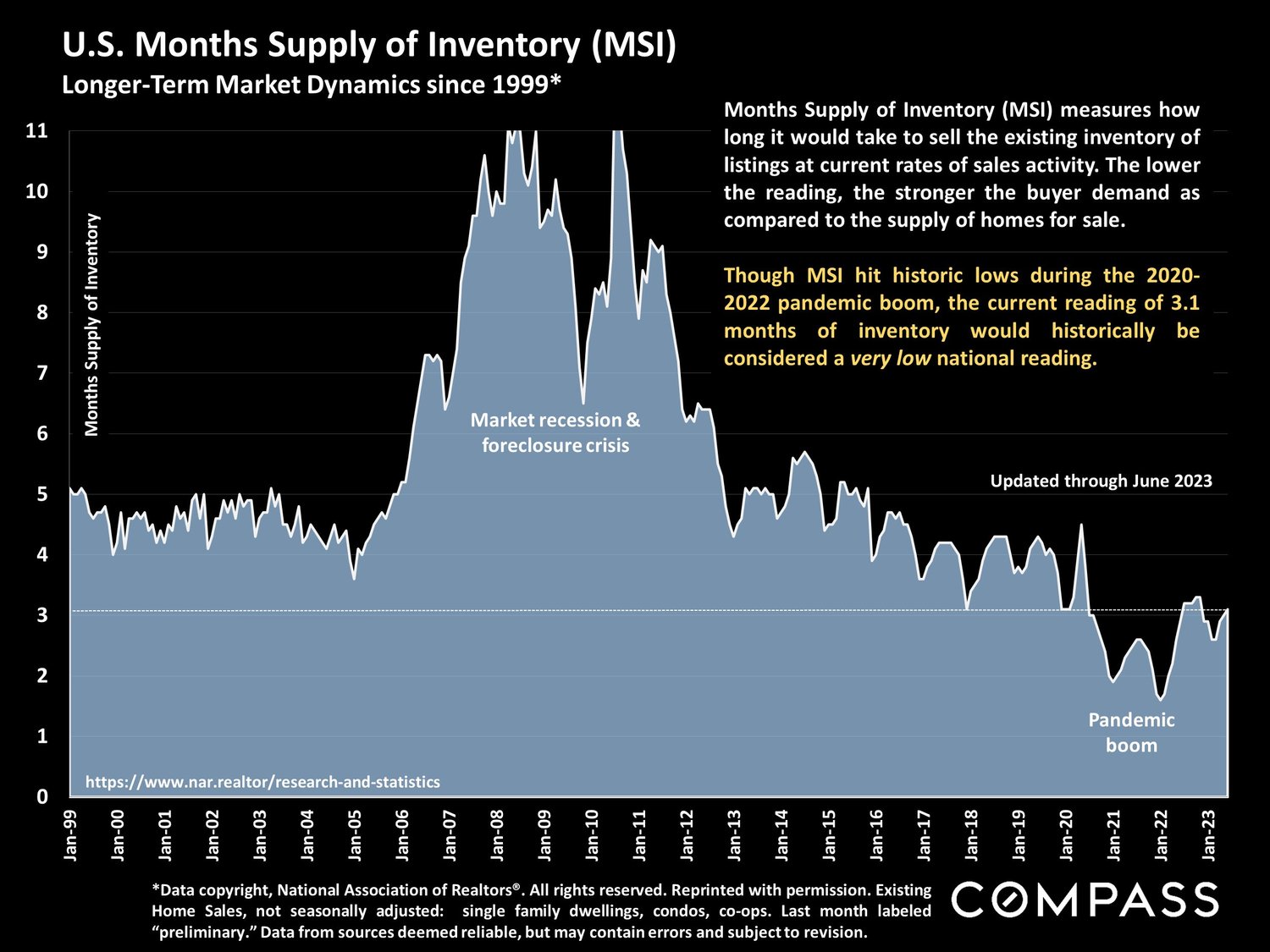

The number of homes for sale remains very low, clearly inadequate to demand. Besides general economic factors, it ebbs and flows according to seasonal trends.

Months-supply-of-inventory compares the supply of listings to buyer demand: Lower readings commonly signify more competitive, more heated markets.

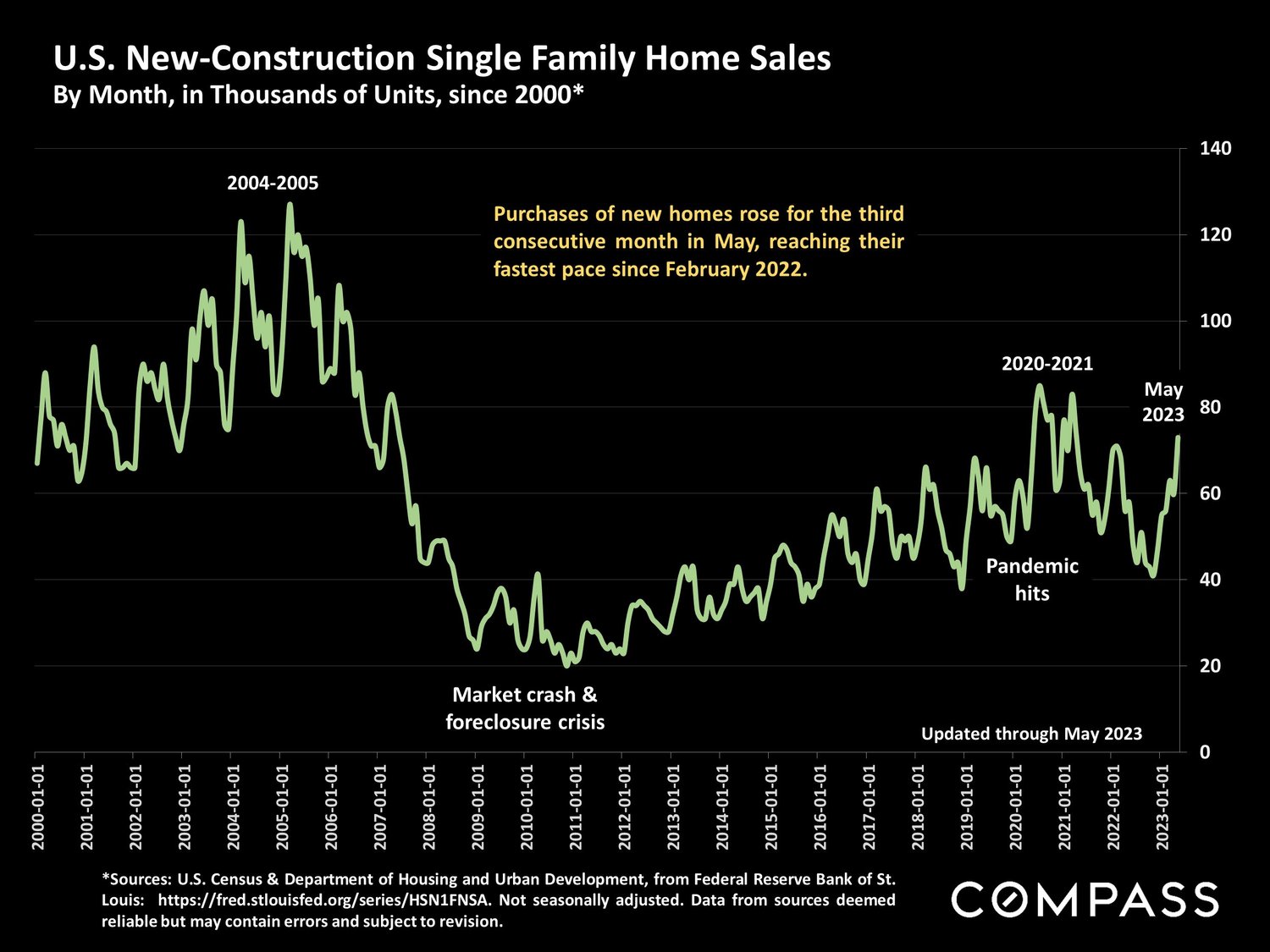

3. Increased Construction Starts:

Fortunately, the market has seen a positive development with developers initiating more new construction projects. This surge in construction starts is expected to bring much-needed inventory to the market, alleviating some of the supply constraints. This indicates a potential trend towards market normalization, particularly when considering seasonal fluctuations.

4. Volatility and Predictions in the Housing Market:

While it is difficult to predict with certainty, there are indications that market volatility is decreasing. However, it is crucial to consider the influence of interest rates on future trends. If interest rates fall and a flood of new buyers enter the market, thereby increasing demand, we may witness a further rise in prices. This prediction is contingent upon the interplay between interest rates, buyer activity, and its subsequent effect on pricing dynamics.

5. The Overlooked Impact of Mortgage Rates on Supply:

When discussing interest rates, the focus is often on how they affect demand. However, it is equally important to consider their impact on supply. Lower interest rates can incentivize some homeowners to hold onto their properties as the cost of borrowing decreases. This behavior can further exacerbate the existing supply shortage, making it crucial to study the interrelationship between interest rates and supply dynamics. On the other hand, lower interest rates can release some of the “mortgage lock” effect as homeowners with existing low mortgage rates are more amenable to the idea of trading their property. But would that be enough to offset the demand brought on by a drop in interest rates?

By analyzing national real estate trends, it is evident that the market is experiencing a gradual appreciation in median home sales prices. However, new listings are still below previous levels, and the declining inventory poses a challenge. The increased construction starts offer a glimmer of hope, but further efforts are required to address the supply shortage adequately.

While volatility appears to be decreasing, the potential impact of interest rates on supply and demand cannot be overlooked. Monitoring the interplay between interest rates, buyer activity, and pricing dynamics is essential to make accurate predictions. Buyers and sellers can make informed decisions and navigate the real estate landscape successfully by staying informed and adapting to the evolving market conditions.